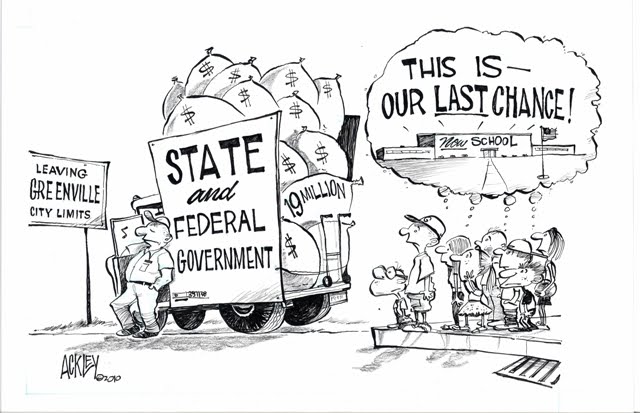

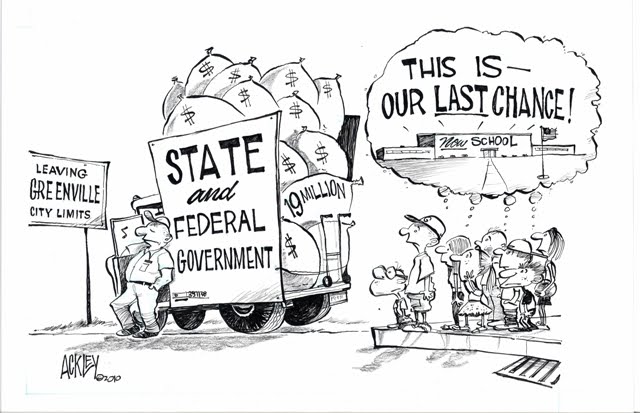

Why a Special Election? To save taxpayer dollars on this project! The district has a limited time to take advantage of low construction costs, low interest rates, State dollars and Federal Stimulus money. February 2nd is the first opportunity to do this.

Why ask voters to approve this issue now? We have an opportunity to partner with Ohio and the US Government to maximize Greenville district residents’ savings. A bond issue must be passed by August, 2010, to get our share of State money which is almost 8.8 million dollars ($8,800,000).

Bonds passed during this time will have the advantage of Federal Stimulus funds to subsidize the interest, saving dollars for local taxpayers. Over the life of the issue, 37 years, this could create another 10.5 million dollars ($10,500,000) of savings!

What are the educational advantages? Improved safety for labs, handicapped accessibility throughout, sufficient electrical power for technology in the classroom and improved learning environments with consistent heat.

Will a new building be safer for the children in our district? Yes! Elimination of asbestos. Buildings secured from intruders. Walls that will not collapse. Improved air circulation.

Are there other reasons to build now, even with the economy? Interest rates are at an all time low and will reduce bond costs. Economists predict this is short term. Now is the time to invest in the future of Greenville.

Construction has bid well under expected cost estimates due to need for work and lower material costs. Building projects can bring employment to a community. Local contractors will be able to bid on these projects and prevailing wage will not be required in this construction project.

What savings are anticipated with a new building? The district plans to merge two buildings into one which will restructure and reduce many costs of the district. Transportation, staff, instructional supplies, utilities and maintenance are just a few of the items which will be reduced through new construction and consolidation.

Why a Bond Issue?

A bond issue is for a school district like a mortgage is for a homeowner; it secures debt. Helping with the mortgage are the State and Federal governments. Ohio will provide dollars from the OSFC funding earmarked for building schools. The US Government provides Federal Stimulus dollars from the Build America Bond program.

How can the State of Ohio fund anything?

Everyone knows that the state is suffering financial woes from the loss of revenues. However, there is money that by law is “earmarked” for specific purposes. If passed, the money is ready and waiting for Greenville to use NOW!

Why always the property owner?

A property tax only requires half as much effective millage as a school district income tax. This is because all businesses like big retailers will pay this property tax and help share the tax burden for the community.

Also the Federal Stimulus money available is much more effective on property tax because of the type of indebtedness.

Corporations do not pay a school district income tax.

When is the Election?

Tuesday, February 2nd, 2010, from 6:30 AM to 7:30 PM. If you are unsure of where you vote, check with the Darke County Board of Elections for your precinct location by calling 548-1835 or emailing darke@sos.state.oh.us.

Is there anything else on the ballot?

No. It is crucial to take advantage of state and federal dollars now. The availability of these dollars is quickly coming to an end. It is absolutely necessary to move ahead now so that a new school can be constructed at the lowest costs in years.

My children are grown … Why should I pay more taxes?

Good schools equal good communities. Sometimes it takes a village, or in this case, a city to enhance the quality of a community’s well-being. The school is at the center of all activities within the community.

Economic Development opportunities hinge on the resources of the community. The continued quality of the district will impact the economic development for the future.

Why weren’t the North and Gettysburg School buildings kept? Projected enrollment and continued maintenance costs of aging buildings did not merit the continued district ownership of these facilities. Greenville would have been mandated to spend hundreds of thousands of dollars into these facilities for their continued use. Other private agencies are not forced to meet these same requirements.

What Levy passed in May, 2009? It was the Emergency Levy to fund operations while the State of Ohio sorts out its financial woes. The three year levy gave the district more time to understand the change in finances at the state level. A new building would further merge our district perpetuating the savings that we have experienced since 2007, with our previous building consolidations.

What is the Plan?

What is the building plan? One modern fifth through eighth grade facility will replace two aged buildings. Greenville Middle School (South) was built in 1911 and Greenville Junior High School was constructed in 1923. The original South School was being built as the Model T was starting production.

Will a new High School be built on this same property? No. The architects have confirmed that the existing acreage owned by the district is not sufficient to build a new High School that would meet Ohio School Facilities Commission (OSFC) specifications.

How will this building look? Who makes that decision? The community’s desires will be incorporated into the building. The architects and engineers will involve the community, educators and others in the process. The OSFC has been involved in construction of hundreds of buildings and specifies the general square footage and the basic needs for education.

What are we doing with the old buildings? The South School has demolition dollars budgeted within the project with the option to sell the building should that be in the best interest of the taxpayer. The Junior High has potential for other uses by the community and will not be demolished.

What about the money put in the Junior High in 2008 to reopen the building? Under the Exceptional Needs Program, the OSFC will reimburse the district a large portion of the construction cost as a result of the March, 2008, collapse. Since a district needs temporary student classrooms, also known as “swing-space” during its construction phase, the Junior High costs would qualify as temporary housing expenditures under the OSFC rules.

What does it mean to have a “green” building? The benefits of “green” technology have a positive effect on student health, attendance and performance. While the state is sharing in the cost of the upfront construction, the benefits — including energy savings — go directly to districts like Greenville who participate.

How will the district maintain this facility? Part of the cost of the bond issue is a State required, .5 mill for facility maintenance for 23 years.

What is the Cost?

Currently Greenville City School District has not had any debt since 2001!

The Building will cost $33.5 million ($33,500,000) with the Bond Issue generating $ 24.7 million ($24,700,000) for construction of a fully-furnished facility with the state share of $ 8.8 million ($8,800,000).

How much will this cost the homeowner? An owner of a $100,000 home would pay less than 33¢ per day or a total of $118.65 per year.

How much will this cost Greenville farmers? Farmers who are participating in CAUV (current agricultural use value) will pay less than 50¢ an acre annually (based on average federal and state taxes) to help build a middle school facility in Greenville based on average federal and state tax rates.

I am a senior citizen. Do I receive any relief on this bond issue? Governor Ted Strickland signed into law an expanded homestead exemption that provides additional property tax relief to qualified senior citizens and permanently and totally disabled Ohioans.

Previously, most senior citizens and disabled Ohioans were excluded from the Homestead Exemption because of income levels. The new exemption offers eligible homeowners, regardless of income, the opportunity to protect up to $25,000 of the market value of their homestead (a dwelling and up to one acre of land) from property taxation. For example, if a home is valued at $100,000, the property tax will generally be billed as if the home were valued at $75,000.

Ohio will make up the difference in taxes to the school for many seniors.

skip to main |

skip to sidebar

Bond Issue Call in Show Replay On Channel 5 GPAT

Friday evening at 8pm

Sat. 10am-2pm-8pm

Sun. 8pm

Mon. 10am-2pm-8pm

Proposed New Middle School

Channel 5 GPAT BOND ISSUE "Replay" Call in SHOW

Bond Issue Call in Show Replay On Channel 5 GPAT

Friday evening at 8pm

Sat. 10am-2pm-8pm

Sun. 8pm

Mon. 10am-2pm-8pm

Our Last Chance

Election Day

Election Day August 3, 2010

You can NOW vote early at the Board of Elections

You can NOW vote early at the Board of Elections

FAST FACTS

Cost - Taxpayer

• 2.9 Mill Bond Issue for 37 years 5-8th Grade Building – Fully Furnished

• .5 Mill for 23 years Facility Maintenance (OSFC Requirement)

• Total Cost to Property Owner $119 per year on $100,000 home

Formula for figuring tax cost:

Appraisal (Fair Market Value) x 35% Divided by 1,000 x 3.4 = Cost To Taxpayer

Example: $100,000 x 35% ÷ 1,000 x 3.4 = $119

Farmers – 50 cents an acre annually.

A farmer who owns an 80 acre tract of land on CAUV will pay less than $40 a year.

Cost – Facility

• $33.5 million 5-8th Grade Building – Fully Furnished

• $24.7 million Taxpayer Share

• $8.8 million State Share

Your support FOR the new middle school equals:

State - 8.8 million dollars to help build a 5-8 school

State - Rebate dollars for Junior High Repairs

Federal - Stimulus money to lower bond interest rates

Greenville School Board - dropped grades K-12 workbooks, flat and lab fees immediately upon passage

Greenville School Board - the new 5-8 building includes a Senior Citizen center at no extra cost.

The State funds 40% of a BASIC facility. The OSFC formula only funded a BASIC building housing 774 students. The district is currently averaging over 210 students per grade level in grades K-4. Additional academic square footage and upgrades for long term energy efficiencies add to the total cost of the local taxpayer share.

• 2.9 Mill Bond Issue for 37 years 5-8th Grade Building – Fully Furnished

• .5 Mill for 23 years Facility Maintenance (OSFC Requirement)

• Total Cost to Property Owner $119 per year on $100,000 home

Formula for figuring tax cost:

Appraisal (Fair Market Value) x 35% Divided by 1,000 x 3.4 = Cost To Taxpayer

Example: $100,000 x 35% ÷ 1,000 x 3.4 = $119

Farmers – 50 cents an acre annually.

A farmer who owns an 80 acre tract of land on CAUV will pay less than $40 a year.

Cost – Facility

• $33.5 million 5-8th Grade Building – Fully Furnished

• $24.7 million Taxpayer Share

• $8.8 million State Share

Your support FOR the new middle school equals:

State - 8.8 million dollars to help build a 5-8 school

State - Rebate dollars for Junior High Repairs

Federal - Stimulus money to lower bond interest rates

Greenville School Board - dropped grades K-12 workbooks, flat and lab fees immediately upon passage

Greenville School Board - the new 5-8 building includes a Senior Citizen center at no extra cost.

The State funds 40% of a BASIC facility. The OSFC formula only funded a BASIC building housing 774 students. The district is currently averaging over 210 students per grade level in grades K-4. Additional academic square footage and upgrades for long term energy efficiencies add to the total cost of the local taxpayer share.

Proposed New Middle School

Proposed New Middle School

Campaign Team

- Team Members:

- Honorary Chairperson– Jim Buchy Co-Chair–Eileen Litchfield Co-Chair–Bill Funderburg

Conceptual Plan

Questions

If you have any questions, please contact us at 937-548-3185

Search This Blog

Support Greenville Schools Store

Visit: http://www.supportgreenvilleschools.com/ to purchase your I Support Greenville Schools apparel. 20% of the proceeds will be dontated to Citizens for Quality Greenville Schools.